Johnson Controls takes smart decision in commercial collections

Introduction

When the UK and Ireland division of Johnson Controls, a world leader in smart buildings, was confronted with rising volumes of commercial debt, one of its biggest challenges was engaging with its customers and getting replies to the follow-up letters and emails being sent.

The sheer volume of clients who did not respond was difficult to manage because it was hard to know whether emails had been received or read. It was therefore difficult to know whether the customer was deliberately avoiding payment and should be reported to the credit reference agencies, or whether the communication was simply never received.

Angelica Bontea, the Senior Finance Manager who runs the order-to-cash teams for the UK and Ireland division of Johnson Controls, decided to try something different. She engaged with a new automated cloud-based platform, Debt Register, and instantly experienced an improvement in collections volumes. She also experienced a surge in team morale.

Easy to implement

Angelica emphasises that Debt Register has been well received by her team because it is easy to implement and has some innovative features that solve the fundamental issues of high client volumes: “We had the option to upload files with hundreds of accounts if it was needed,” she continues. “This reduced our manual work significantly, and then, obviously, this was adopted much more easily by the team.

“Then there are all the reporting capabilities that we can pull out and have a better understanding of our data and analysis. It is also easy to add users or report clients in bulk; you can do many things through ancillary feeds. So, I would say it was received well because it served the purpose of covering a gap in our process.”

The ease with which the Debt Register platform could be integrated within day-to-day operations was essential: “The platform is a cloud-based solution and is very user friendly,” she says. “At the beginning, we had people training with the Debt Register team. That took no more than an hour, and once the knowledge was sitting in our team, they were able to train others internally.”

Plug and play

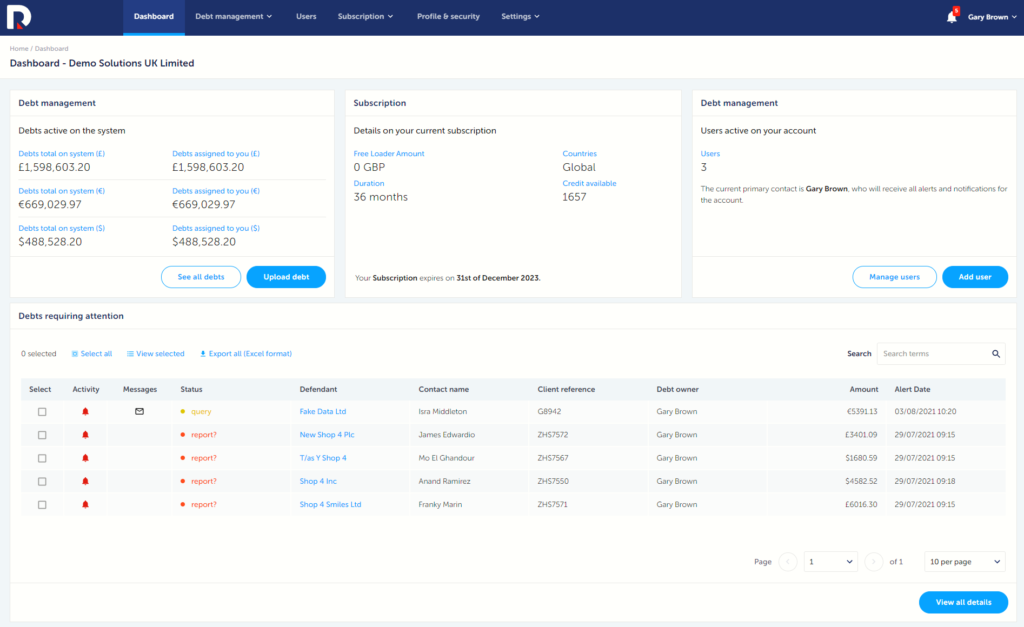

Debt Register is an award-winning cash recovery tool that credit and collections teams can simply plug in and set to work, freeing them to focus on more value-added activities. Angelica’s team simply upload an overdue invoice with all of the debtors’ details and the system does the rest. Automated emails inform the debtor that any non-payments will be reported to the credit reference agencies which ultimately impacts their own credit rating.

“When we learned that you have the option to report a customer, which obviously has a more serious impact because every company would like to have a good credit score, it’s easier for them to do business,” Angelica explains. “The fact that we would have the option to check if the client received and was reading the e-mail was actually another powerful element.”

Crucially, the system has a layer of artificial intelligence (AI) built in to recognise errors and prevent chasing expired emails, staff that have left or even companies no longer in business. This helps Angelica address a key challenge: “Debt Register resolves the issue of not getting replies from all our clients,” she says, “and it also addresses the incorrect contacts we might have in our database.”

Improving morale

Debt Register is designed to complement and support the credit team, and to that end, Angelica was pleased with the quick response her team received to any queries: “My team were happy to see how quickly Debt Register responded to our queries,” she adds.

“This was really a pleasant surprise because every time we need to implement something new it means change, and people are understandably resistant to it. I would say we easily overcame all of the challenges we had, and this has made for a successful partnership.”

Angelica says the benefits of Debt Register were realised almost immediately: “We could see the benefits after the first month,” she says.

She also sees a positive effect on her team: “We started with the end goal of improving collections in mind and seeing how the tool is helping them to collect the cash better and faster is definitely having a positive impact on their morale.”